Today and yesterday were terrible days. I made some terrible trades jumping in and out second guessing myself and eating the spread and losing 6k the first day and 4k the second day basically eliminating all of my profits. If I had just stuck with my trade and rode the volatility instead of thinking I got the trend wrong and reversed I'd be fine but I put too much money down so I got scared and bailed out only to eat a loss and miss profit after.

Lesson is that I shouldn't bet so much that it affects me like this but even if I do, I need to recognize to let it ride and not make out with pennies on the dollar. Might as well eat a fucking full loss on a daily before I sell out, or wait till EOD therefore I might switch to 1 DTE with fewer options now or pick a closer strike.

It's a good lesson that goes back to what I knew before which is to not spend too much time watching the price and over trading. This is where I think a program would do it better than me to follow my rules.

Yea everyone lost their minds when Trump said there might be a recession during this transition to Maga.

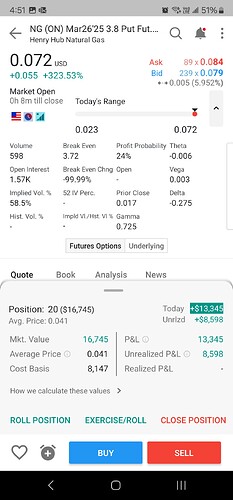

I was about to sell because NG is up but I decided to not bitch out like I did with the other trades which net me a loss and would have been profitable. I am in this to ride or die. That money is gone if I don't make it back even at the least but if it does go even there's no way I'm gonna sell if there's more than 5 days left on the contracts.

I'm gonna stop looking at the price. Can't believe it if I lose this. Big wake up call that I suck dick at risk management. F. Need to stick to just stocks. Options are too unforgiving to regarded behavior.

Yea weather experts please explain why the entire country is heating up and demand is dropping for gas but the price is still sky high. Make it make sense. Who is buying gas at these prices?

Aye carumba man

Its not illogical. You just dont understand the logic

Stop whining like a baby when things dont occur how you think they will

I genuinely trying to understand the cause. I have heard the theories from the tarrifs to the threat of tarrifs and war etc... But what is the actual reason that is manifesting in real life? Maybe I will never know but to me it feels like a manipulated market play for a squeeze. I cannot find any reason for this price action with so many fundamentals being so bearish and the movement feels so bizzare watching these spikes, maybe people working in collaboration to hold back supplies and fudge numbers. It's absolutely possible with how thin the NG market is. This was almost like a honey pot situation of just continually pumping up the market and baiting traders to jump in.

When the gas spiked in Ukraine, it was clear why but right now with Trump nuking all international relations and Europe possibly buying Russian gas again NG is like nope, ignore reality, ignore weather, ignore bearish news, fuck it we on a moonship and gonna go fast as fuck boiii

NG does a similar thing every few years where it just totally ignores fundamentals so when the price is floored at like $2, and we're getting hit with winter storms and record breaking cold, that shit drops to $1.50 Kekw.

Those were times of peace and fewer LNG exports but still fucking hilarious. We are at lower storage levels. Truth be told if the storage report this week isn't Hella bearish I think we might have to swich long. These prices could be here to stay if this boils down to a simple supply demand problem and the price is high because storage is at a historic low compared to the 5 year avg.

If I so switch I'm only going to sell half and just do a strangle. This way I won't shoot myself if it does still tank.

ahh the classic /r/wallstbets GME "its market manipulation the hedgies!!!" cope

Glorious day. Made everything back. Account up over 200%. Going to hold, still a lot of time left on the contracts. I can see this dropping a lot further in 2 weeks. I can also see this rebounding back to 4.50 and putting myself on suicide watch for not cashing out.

I mean how did I even get here, it's like a broken clock is still right twice a day because by some accident of chance that I didn't sell my puts at a loss 2 days ago. I put in the order but it didn't get filled, and then I cancelled it because I didn't want to drop further. If it did fill and I went long, I'd have gotten wiped out totally. I was about to sell everything for 3.5k and now it's worth over 16k for holding. I would definitely be feeling sadness if I had sold. The same happened a few days ago with my CL trades. I doubted myself and bailed out only for it to spike down and turn green.

Patience is the most important thing but also not letting the stress get to you by focusing on the worst case scenario.

Everything is gone. Hard lesson is I suck at trading because I'm a gambler who has poor impulse control and gets easily emotional therefore as a last hurrah I am putting in another grand to Short TSLA and then I'm done forever. No more derivatives just stock.

Do you think you’d have a better batting average if you had a really good log of your trades over time

Bro quit the shorting if you know you have a gambling problem. And probably don’t short Tesla randomly and instead do it before the shareholder 2025 thing if you really have to

Yes, basically the only way I will trade again is using a program to do it. I'm still going to gamble with news releases but I'm not deluding myself anymore that it is anything besides gambling.

if you are shorting more than like a few one offs you are doomed to have a bad average. It really only makes sense to me in the context that it’s only worth a few gambles in your life (if any) and thus based on what you understand best and not something you kinda grasp